Banking services

Domestic Money Transfer

That moment when you need to send money in a hurry can happen anytime. It often happens when banking hours are closed and you’re somewhere else with the recipient’s bank account number on hand. Easyplus Transfers allows you to send money instantly at any hour, even beyond banking hours to any IMPS & NEFT-supported Indian bank from Easyplus retail outlets.

The sender can send money through our retail outlets across India with ease. The money sent to the recipient is credited to their account within 10 seconds. Customers typically make these transactions through highly secured servers via cash or credit cards. Easyplus facilitates transactions according to RBI-approved guidelines and as per the PPI and Banking Correspondent license holder guidelines.

Aadhaar Enabled Payment System

Sure, your bank is awesome. But it’s just as easy to set up a Easyplus retail touchpoint for all your banking needs. Aadhaar Enabled Payment Services use Aadhaar Data and Biometric Authentication for making withdrawals and transfers, and accessing bank statements–all without having to visit your branch. Instead of going out hunting for an ATM or bank branch, customers can pop into their nearest Easyplus retail location when they need to make some transactions.

Micro ATM

There are millions of bank customers who need to withdraw money. This is a huge opportunity for ATMs. Quickly setup your ATM with a minimum KYC, small investment and huge earning potential.

Micro ATM services are becoming increasingly popular due to their convenience and accessibility. They enable customers to make easy, secure, and convenient payments without having to visit a bank branch or ATM machine. This service helps customers save time and money by providing them access to their accounts from anywhere in the world.

NO hidden charges – NO monthly rental. Simple one-click installation and easy activation process. Easyplus ATM requires absolutely no technical skills to install or operate. You can start almost immediately with a very small investment. With multiple device options you can choose the right one to serve your specific users.

Easyplus Pay offers two types of devices, both are compact, sturdy and easy to operate. You should choose one based on the type of customer you want to service and your operating preference. The card swipe machine is best for you if you want to operate it from one fixed location and your customers prefer to pay using a credit or debit card.

The AADHAAR based finger-print device is the right choice for you if you want to move around and if your customers prefer to withdraw money using their AADHAAR linked thumb impression.

The AADHAAR based finger-print device is the right choice for you if you want to move around and if your customers prefer to withdraw money using their AADHAAR linked thumb impression.

All of Easeplus devices and services have all the required approvals. The ATM devices are UIDAI compliant, 100% secure and provide real-time or instant transactions and settlement. A live transaction report is also available to you on your mobile and computer.

PayPoint offers best-in-class support and training. With regional offices in Mumbai, Thane, Delhi, Lucknow, Hyderabad, Guwahati and Calcutta; and operations across India the company closely understands the retailer’s needs and concerns. Systems, processes and support have been refined over the years with learning from more than 64,000 retailers.

The dedicated regional, limit, support and technology desks provide you with all the assistance you need to manage and grow your business. The company also creates and shares detailed training material online which you can access at any time.

The dedicated regional, limit, support and technology desks provide you with all the assistance you need to manage and grow your business. The company also creates and shares detailed training material online which you can access at any time.

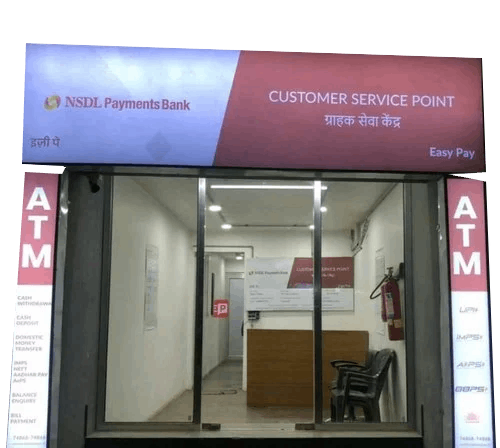

NSDL Kiosk Banking

- Limit grant on holidays too

- MICRO ATM is also available for cash withdrawal facility

- Only FINTECH company offering MICRO ATM In the market

- Only company offering micro insurance product to the merchants

- Unlimited cash withdrawal from MICRO ATM without any MDR charges

- Immediate, unlimited and free IMPS settlement for all AEPS and MICRO ATM withdrawals

- Only remittance company offering instant debit card on account opening